What Line Is Taxes Paid On 1040 . 22.0% tax as a percentage. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Subtract line 24 from line 33. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). Form 1040 is what individual taxpayers use to file their taxes with the irs. The form determines if additional. If the amount on line 33 is. this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid).

from www.taxgirl.com

your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). 22.0% tax as a percentage. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). Form 1040 is what individual taxpayers use to file their taxes with the irs. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. The form determines if additional. If the amount on line 33 is. Subtract line 24 from line 33.

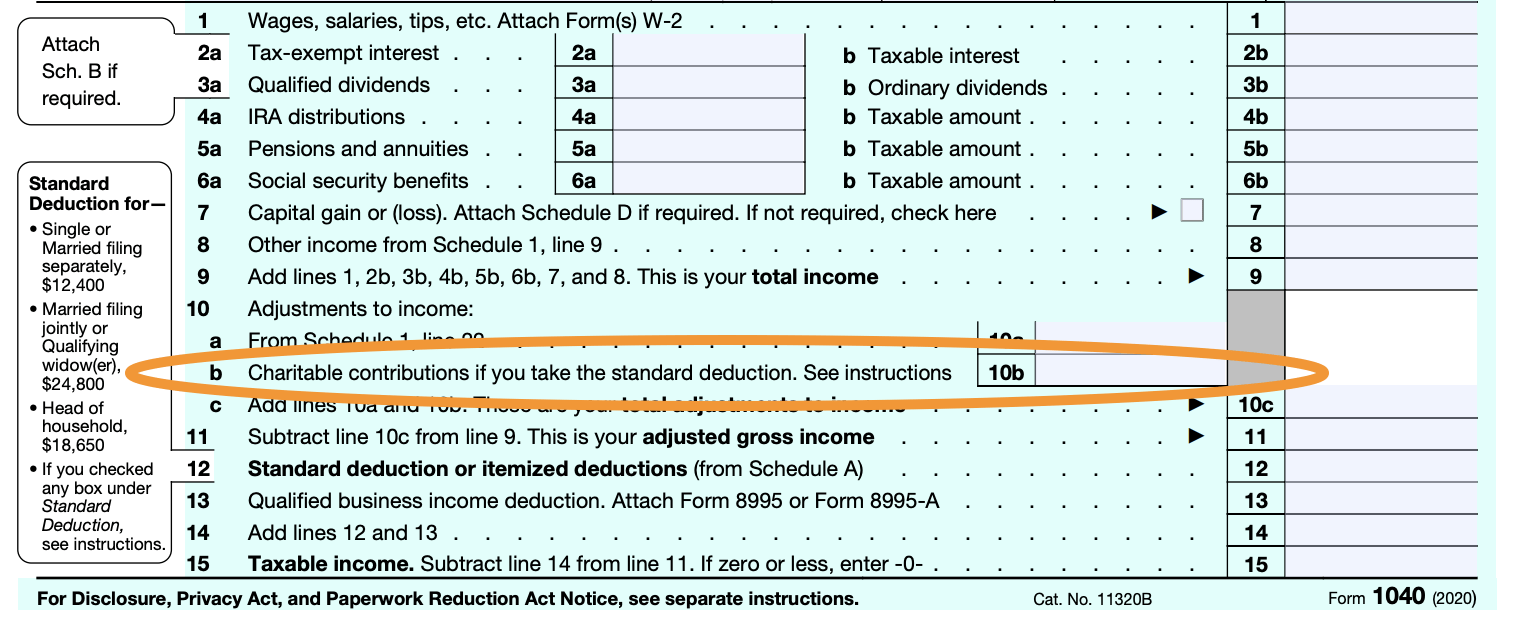

What’s New On Form 1040 For 2020 Taxgirl

What Line Is Taxes Paid On 1040 this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. 22.0% tax as a percentage. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Form 1040 is what individual taxpayers use to file their taxes with the irs. Subtract line 24 from line 33. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). If the amount on line 33 is. The form determines if additional.

From support.stridehealth.com

How do I file estimated quarterly taxes? Stride Health What Line Is Taxes Paid On 1040 Subtract line 24 from line 33. The form determines if additional. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year. What Line Is Taxes Paid On 1040.

From www.signnow.com

1 Wages, Salaries, Tips, Etc from Federal Form 1040 or 1040 SR, Line 1z What Line Is Taxes Paid On 1040 use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). your tax. What Line Is Taxes Paid On 1040.

From trudystaxes.com

The ABC’s of the 1040! Individual Tax Planning Part 1 Learning What Line Is Taxes Paid On 1040 The form determines if additional. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). If the amount on line 33 is. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Form 1040. What Line Is Taxes Paid On 1040.

From bookkeeperla.com

How to Pay Your IRS 1040ES Estimated Taxes THE Ultimate Bookkeeper What Line Is Taxes Paid On 1040 your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. 22.0% tax as a percentage. Subtract line 24 from line 33. The form determines. What Line Is Taxes Paid On 1040.

From ttlc.intuit.com

How to understand Form 1040 What Line Is Taxes Paid On 1040 your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). The form determines if additional. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. 22.0% tax as a percentage. Form 1040 is what. What Line Is Taxes Paid On 1040.

From www.taxuni.com

1040 Schedule 1 2021 What Line Is Taxes Paid On 1040 The form determines if additional. Form 1040 is what individual taxpayers use to file their taxes with the irs. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to.. What Line Is Taxes Paid On 1040.

From www.youtube.com

Form 1040 Tax Return Guide YouTube What Line Is Taxes Paid On 1040 Form 1040 is what individual taxpayers use to file their taxes with the irs. this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). the amount of income. What Line Is Taxes Paid On 1040.

From www.metaxaide.com

Describes new Form 1040, Schedules & Tax Tables What Line Is Taxes Paid On 1040 your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. The form determines if additional. Form 1040 is what individual taxpayers use to file. What Line Is Taxes Paid On 1040.

From tourismcovidprotocol.com

What is IRS Form 1040? (Overview and Instructions) Bench Accounting What Line Is Taxes Paid On 1040 use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. Form 1040 is what individual taxpayers use to file their taxes with the irs. . What Line Is Taxes Paid On 1040.

From 1044form.com

Obama S IRS Unveils New 1040 Tax Form International Liberty 2021 Tax What Line Is Taxes Paid On 1040 If the amount on line 33 is. Form 1040 is what individual taxpayers use to file their taxes with the irs. use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. The form determines if additional. Subtract line 24 from line 33. the amount. What Line Is Taxes Paid On 1040.

From www.taxgirl.com

IRS Releases Form 1040 For 2020 Tax Year Taxgirl What Line Is Taxes Paid On 1040 Subtract line 24 from line 33. your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). The form determines if additional. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year. What Line Is Taxes Paid On 1040.

From www.dochub.com

1040 form 2023 Fill out & sign online DocHub What Line Is Taxes Paid On 1040 use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Subtract line 24 from line 33. The form determines if additional. 22.0% tax as a percentage. Form 1040 is what individual taxpayers use to file their taxes with the irs. your tax return amount. What Line Is Taxes Paid On 1040.

From www.slideserve.com

PPT Federal 1040 Overview PowerPoint Presentation, free download ID What Line Is Taxes Paid On 1040 the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). Subtract line 24 from line 33. Form 1040 is what individual taxpayers use to file their taxes with the irs. The form determines if additional. your tax. What Line Is Taxes Paid On 1040.

From www.thebalancemoney.com

Where To Find and How To Read 1040 Tax Tables What Line Is Taxes Paid On 1040 If the amount on line 33 is. 22.0% tax as a percentage. The form determines if additional. the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). your tax return amount is, in general, based on line. What Line Is Taxes Paid On 1040.

From es.wikihow.com

Cómo llenar el formulario 1040 del IRS 27 pasos What Line Is Taxes Paid On 1040 this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. Form 1040 is what individual taxpayers use to file their taxes with the irs. The form determines if additional. Subtract line 24 from line 33. the amount of income tax you owe is the total of irs form 1040,. What Line Is Taxes Paid On 1040.

From www.reddit.com

Are qualified dividends included in total (1040 line 6)? r/tax What Line Is Taxes Paid On 1040 use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. Form 1040 is what individual taxpayers use to file their taxes with the irs. If. What Line Is Taxes Paid On 1040.

From blanker.org

IRS Form 1040 Schedule 2. Additional Taxes Forms Docs 2023 What Line Is Taxes Paid On 1040 the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). this guide will help you navigate the complexities of your tax return, including total and adjusted gross income to. Subtract line 24 from line 33. 22.0% tax. What Line Is Taxes Paid On 1040.

From www.cpapracticeadvisor.com

Printable IRS Form 1040 for Tax Year 2021 CPA Practice Advisor What Line Is Taxes Paid On 1040 the amount of income tax you owe is the total of irs form 1040, line 22, minus schedule 2, line 2, the total for the fiscal year to date (since october). use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. 22.0% tax as. What Line Is Taxes Paid On 1040.